Record Annual Revenue of $309M, ARR grows over 30% to nearly $38M

Full Year EPS of $0.31, Adjusted EPS of $1.08

(Minneapolis, MN, November 10, 2021) - Digi International® Inc. (Nasdaq: DGII), a leading global provider of business and mission critical Internet of Things ("IoT") products, services and solutions, today announced its financial results for its fourth fiscal quarter ended September 30, 2021.

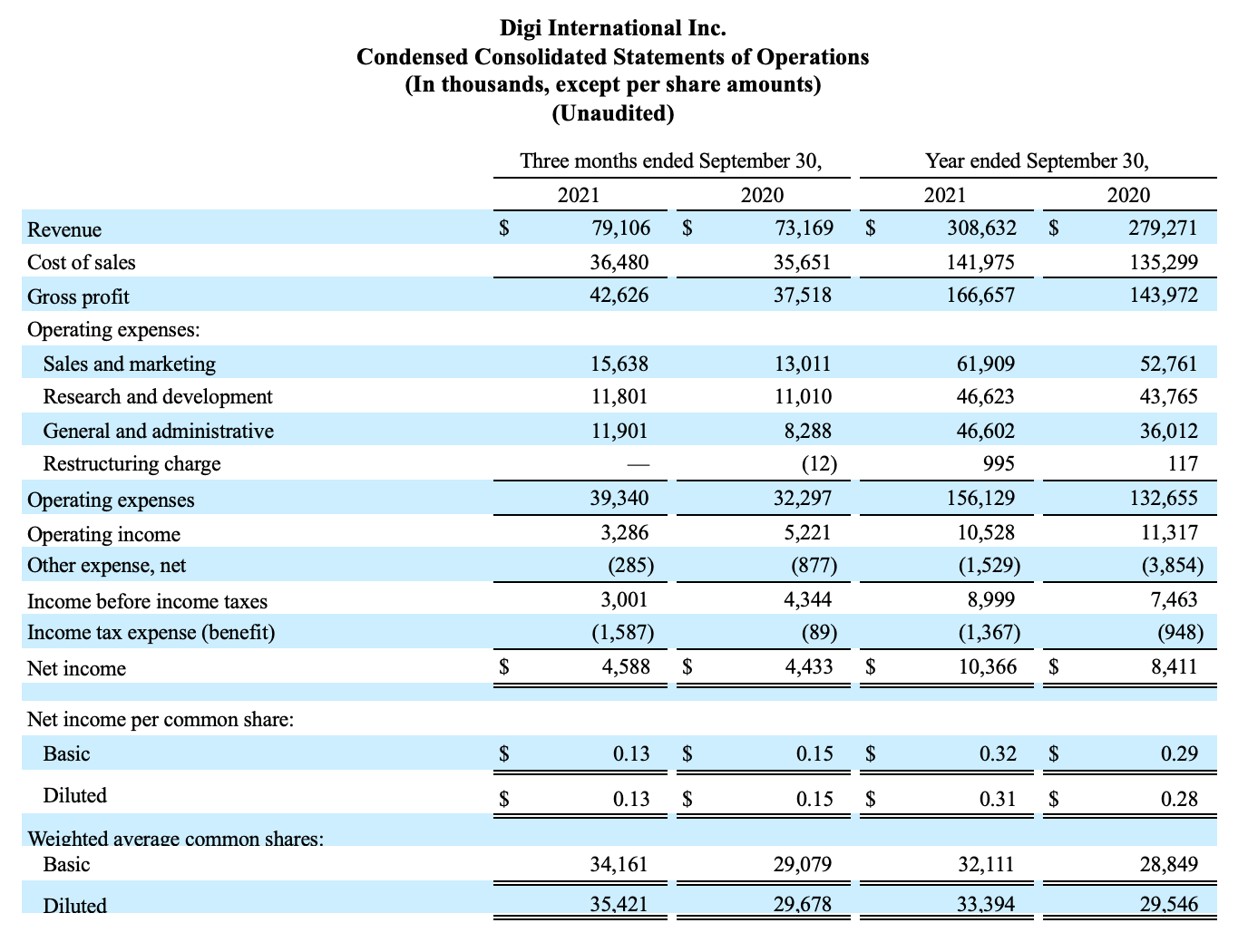

Fourth Fiscal Quarter 2021 Results Compared to Fourth Fiscal Quarter 2020 Results

- Revenue increased to $79.1 million, or an increase of 8.1%.

- Gross margin was 53.9% versus 51.3%. Gross margin excluding amortization was 55.4% compared to 52.9%.

- Net income per diluted share decreased to $0.13, or a decrease of 13.3%.

- Adjusted EPS decreased to $0.25 per diluted share, or a decrease of 21.9%.

- Adjusted EBITDA decreased to $12.0 million, or a decrease of 0.4%.

Full Year Fiscal 2021 Results Compared to Full Year Fiscal 2020 Results

- Revenue increased to $308.6 million, or an increase of 10.5%.

- Gross margin was 54.0% versus 51.6%. Gross margin excluding amortization was 55.5% compared to 53.2%.

- Net income per diluted share increased to $0.31, or an increase of 10.7%.

- Adjusted EPS increased to $1.08 per diluted share, or an increase of 10.2%.

- Adjusted EBITDA increased to $48.3 million, or an increase of 20.1%.

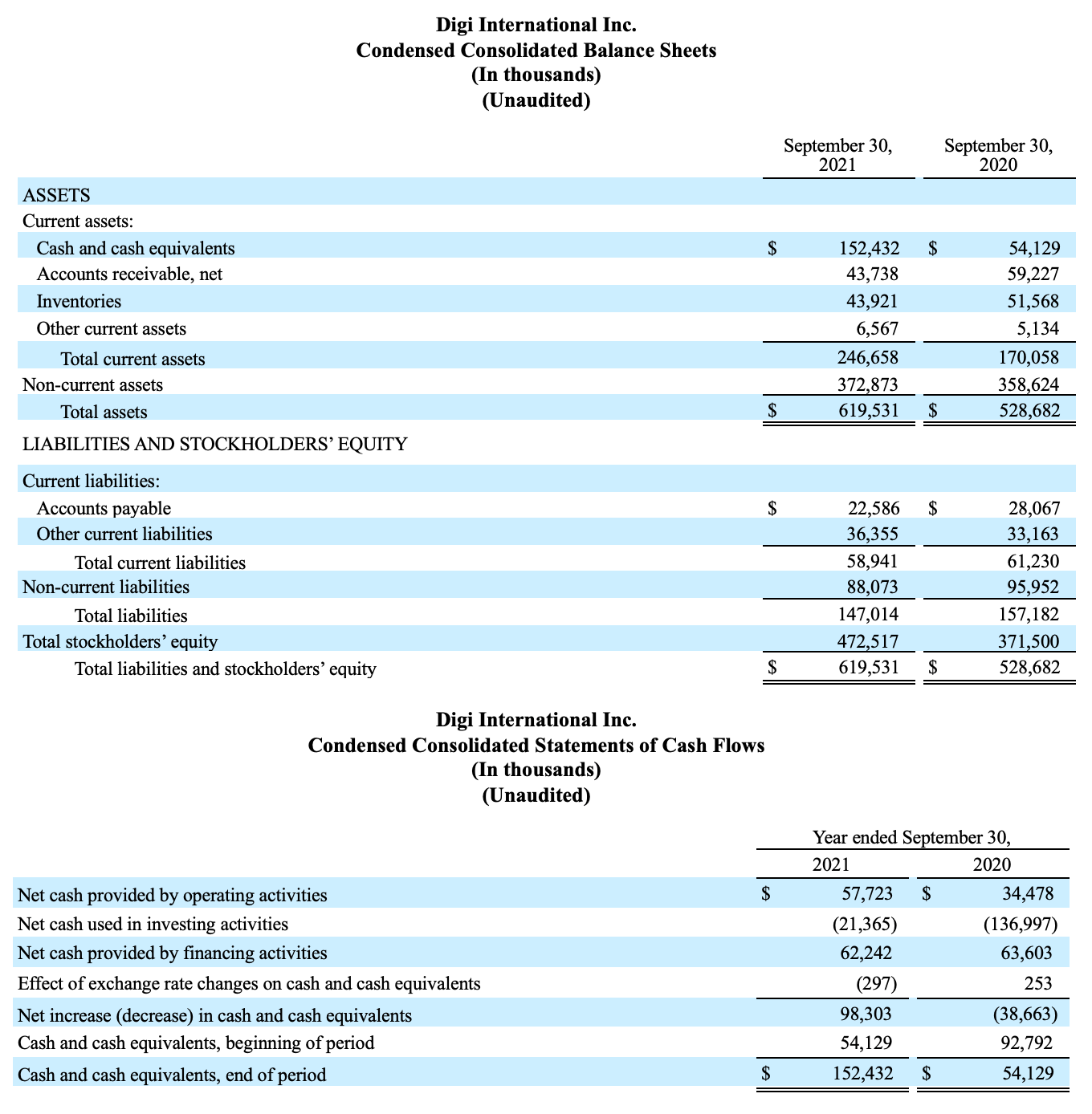

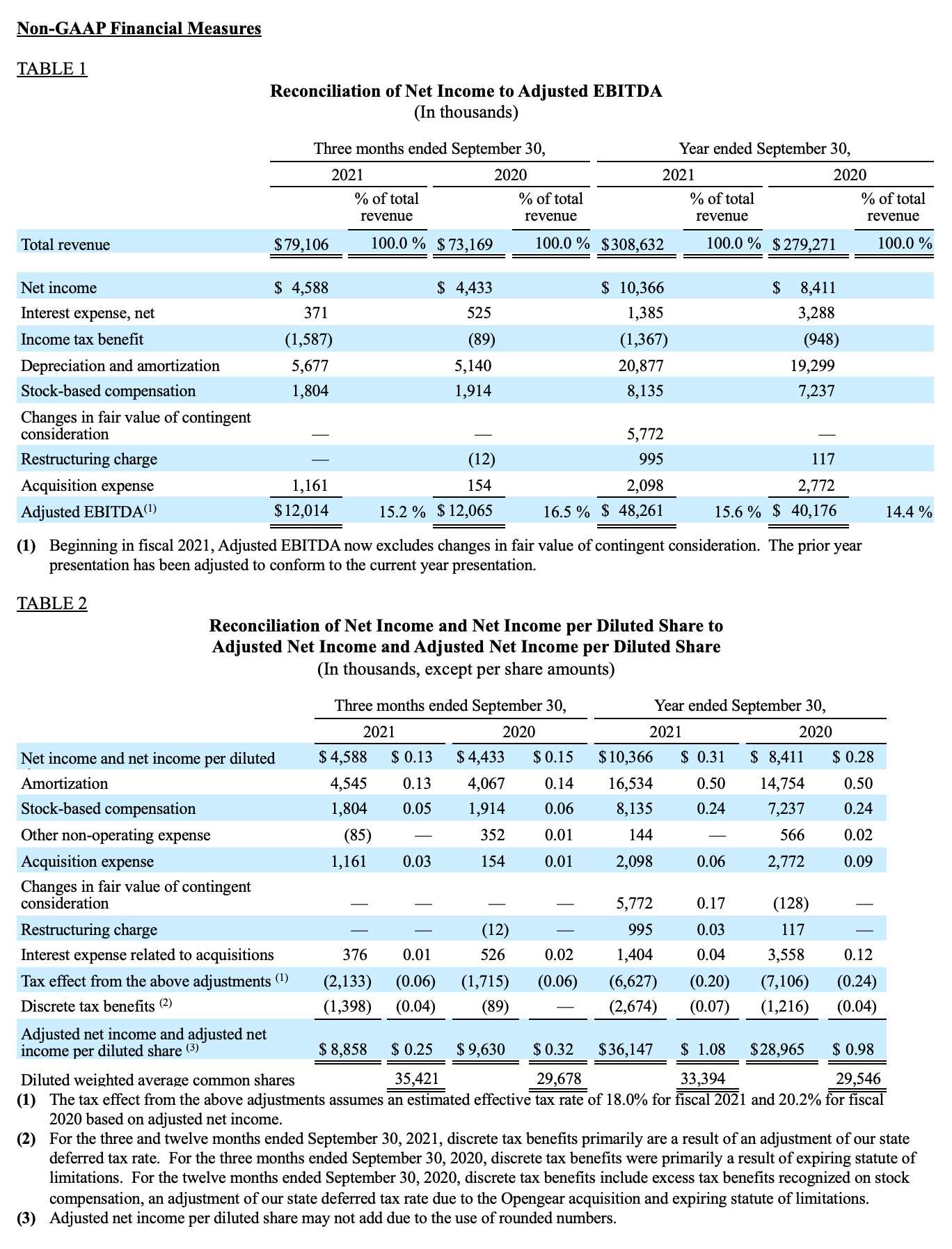

Reconciliations of GAAP and non-GAAP financial measures appear at the end of this release.

“Digi grew revenues over 10% despite unprecedented supply chain challenges,” said Ron Konezny, President and Chief Executive Officer. “Annualized Recurring Revenues growth of 30% demonstrates our relentless dedication to adding more value to our customers’ digital transformations. The addition of Ventus to the Digi family further accelerates our transformation to software, services, and subscription offerings. Digi now provides subscription based services to over 250,000 sites.”

Segment Results

IoT Product & Services

The segment's fourth fiscal quarter 2021 revenues of $69.9 million increased 8.4% from the same period in the prior fiscal year. This increase is attributable primarily to revenue from our console server products. ARR grew 20% from prior year to $13.7 million. Gross profit margin increased 201 basis points to 53.7% of revenues for the fourth fiscal quarter of 2021, due to product and customer mix.

Full fiscal 2021 revenues of $264.2 million were a record for this segment, increasing 5.9% from the prior fiscal year. This increase is attributable primarily to revenue from our console server, embedded and RF products. Gross profit margin increased 285 basis points to 54.7% of revenues for full fiscal 2021, due to product and customer mix.

IoT Solutions

The segment's fourth fiscal quarter 2021 revenues of $9.2 million increased 6.3% from the same period in the prior fiscal year. This increase from the prior year fiscal quarter was driven by increased subscription revenue, partially offset by a decrease in one-time revenue. Annualized Recurring Revenue, or ARR, grew 38% from prior year to approximately $24.3 million. Sites that Digi serves grew to 81,000 sites as of September 30, 2021, compared to 70,000 sites as of September 30, 2020. Gross profit margin increased 713 basis points to 55.6%, due to a large concentration of recurring revenue in the fourth quarter. This also demonstrates the value of our high margin recurring revenue business model.

Full fiscal 2021 revenues of $44.5 million increased 49.5% from the prior fiscal year. This increase was due to growth in both one-time and subscription revenues. Gross profit margin increased 73 basis points to 49.9% as a result of a greater mix of recurring revenue compared to the prior fiscal year.

Fiscal 2022 Guidance

The ongoing supply and freight constraints that have arisen from the global pandemic have made short term predictability challenging. Supply chain issues are impacting our ability to meet customer demand in the near term for certain of our products and are expected to impact our results in at least the first two quarters of fiscal 2022. At present, Digi believes supply chain challenges will ease in the second half of our fiscal 2022. These supply chain issues are not indicative of customer demand. In this context, we provide guidance for our first fiscal quarter of 2022, which includes two months of contributions from Ventus. Revenues are estimated to be $81 million to $85 million, or 11% to 16% growth year over year. We provide earnings guidance on a non-GAAP basis as it is difficult to predict with reasonable certainty items including but not limited to the impact of foreign exchange translation, restructuring, interest and certain tax related events. Given the uncertainty, any of these items could have a significant impact on U.S. GAAP results. Adjusted EBITDA is estimated to be $14.0 million to $15.5 million. Adjusted EPS is anticipated to be $0.30 to $0.34 per diluted share.

The acquisition of Ventus, which has a strong subscription revenue base, is anticipated to have a significant impact on Digi’s financial model. While not providing specific guidance for the fiscal year of 2022, we can provide information on how the Digi financial model is projected to perform during fiscal 2022. We believe revenues will grow between 16% and 23%. We expect our Adjusted EBITDA to grow at a faster rate of between 35% to 55% . We expect to see the gains made in our Gross Margins to hold through fiscal 2022, and our ARR to be at least $90 million at the end of fiscal 2022.

Fourth Fiscal Quarter 2021 Conference Call Details

As announced on October 12, 2021, Digi will discuss its fourth fiscal quarter 2021 results on a conference call on Wednesday, November 10, 2021 after market close at 5:00 p.m. ET (4:00 p.m. CT). The call will be hosted by Ron Konezny, President and Chief Executive Officer and Jamie Loch, Chief Financial Officer.

Digi invites all those interested in hearing management's discussion of its quarter to access a live webcast of the conference call through the investor relations section of Digi's website at www.digi.com. Participants may also join the call directly by dialing (855) 638-5675 and entering conference ID 8825628. International participants may access the call by dialing (262) 912-4765 and entering conference ID 8825628. A replay will be available for one week, within approximately three hours after the completion of the call. You may access the replay via webcast through the investor relations section of Digi's website. Or, you may access the replay via phone by dialing (855) 859-2056 for domestic participants or (404) 537-3406 for international participants and entering access code 8825628 when prompted.

A copy of this earnings release can be accessed through the financial releases page of the investor relations section of Digi's website at www.digi.com.

For more news and information on us, please visit www.digi.com/aboutus/investorrelations.

About Digi International

Digi International (Nasdaq: DGII) is a leading global provider of IoT connectivity products, services and solutions. We help our customers create next-generation connected products and deploy and manage critical communications infrastructures in demanding environments with high levels of security and reliability. Founded in 1985, we’ve helped our customers connect over 100 million things and growing. For more information, visit Digi's website at www.digi.com, or call 877–912–3444 (U.S.) or 952–912–3444 (International).

Forward-Looking Statements

This press release contains forward-looking statements that are based on management’s current expectations and assumptions. These statements often can be identified by the use of forward-looking terminology such as "assume," "believe," "anticipate," "intend," "estimate," "target," "may," "will," "expect," "plan," "potential," "project," "should," or "continue," or the negative thereof or other variations thereon or similar terminology. Among other items, these statements relate to expectations of the business environment in which Digi operates, projections of future performance, perceived marketplace opportunities and statements regarding our mission and vision. Such statements are not guarantees of future performance and involve certain risks, uncertainties and assumptions. Among others, these include risks related to the ongoing COVID-19 pandemic and efforts to mitigate the same, risks related to global economic volatility and the ability of companies like us to operate a global business in such conditions, the current supply chain and shipping market pressures that are negatively impacting both manufacturing and distribution timelines as well as operating costs for a wide range of companies globally, the highly competitive market in which our company operates, rapid changes in technologies that may displace products sold by us, declining prices of networking products, our reliance on distributors and other third parties to sell our products, the potential for significant purchase orders to be canceled or changed, delays in product development efforts, uncertainty in user acceptance of our products, the ability to integrate our products and services with those of other parties in a commercially accepted manner, potential liabilities that can arise if any of our products have design or manufacturing defects, our ability to defend or settle satisfactorily any litigation, uncertainty in global economic conditions and economic conditions within particular regions of the world which could negatively affect product demand and the financial solvency of customers and suppliers, the impact of natural disasters and other events beyond our control that could negatively impact our supply chain and customers, potential unintended consequences associated with restructuring, reorganizations or other similar business initiatives that may impact our ability to retain important employees or otherwise impact our operations in unintended and adverse ways, the ability to achieve the anticipated benefits and synergies associated with acquisitions or divestitures and changes in our level of revenue or profitability which can fluctuate for many reasons beyond our control. These and other risks, uncertainties and assumptions identified from time to time in our filings with the United States Securities and Exchange Commission, including without limitation, our Annual Report on Form 10-K for the year ended September 30, 2020 and other filings, could cause our actual results to differ materially from those expressed in any forward-looking statements made by us or on our behalf. Many of such factors are beyond our ability to control or predict. These forward-looking statements speak only as of the date for which they are made. We disclaim any intent or obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise.

Presentation of Non-GAAP Financial Measures

This release includes adjusted net income, adjusted net income per diluted share and Adjusted EBITDA, each of which is a non-GAAP measure.

We understand that there are material limitations on the use of non-GAAP measures. Non-GAAP measures are not substitutes for GAAP measures, such as net income, for the purpose of analyzing financial performance. The disclosure of these measures does not reflect all charges and gains that were actually recognized by Digi. These non-GAAP measures are not in accordance with, or an alternative for measures prepared in accordance with, generally accepted accounting principles and may be different from non-GAAP measures used by other companies or presented by us in prior reports. In addition, these non-GAAP measures are not based on any comprehensive set of accounting rules or principles. We believe that non-GAAP measures have limitations in that they do not reflect all of the amounts associated with our results of operations as determined in accordance with GAAP. We believe these measures should only be used to evaluate our results of operations in conjunction with the corresponding GAAP measures. Additionally, Adjusted EBITDA does not reflect our cash expenditures, the cash requirements for the replacement of depreciated and amortized assets, or changes in or cash requirements for our working capital needs.

We believe that providing historical and adjusted net income and adjusted net income per diluted share, respectively, exclusive of such items as reversals of tax reserves, discrete tax benefits, restructuring charges and reversals, intangible amortization, stock-based compensation, other non-operating income/expense, changes in fair value of contingent consideration,, acquisition-related expenses and interest expense related to acquisitions permits investors to compare results with prior periods that did not include these items. Management uses the aforementioned non-GAAP measures to monitor and evaluate ongoing operating results and trends and to gain an understanding of our comparative operating performance. In addition, certain of our stockholders have expressed an interest in seeing financial performance measures exclusive of the impact of these matters, which while important, are not central to the core operations of our business. Management believes that Adjusted EBITDA, defined as EBITDA adjusted for stock-based compensation expense, acquisition-related expenses, restructuring charges and reversals, and changes in fair value of contingent consideration is useful to investors to evaluate our core operating results and financial performance because it excludes items that are significant non-cash or non-recurring items reflected in the Condensed Consolidated Statements of Operations. We believe that the presentation of Adjusted EBITDA as a percentage of revenue is useful because it provides a reliable and consistent approach to measuring our performance from year to year and in assessing our performance against that of other companies. We believe this information helps compare operating results and corporate performance exclusive of the impact of our capital structure and the method by which assets were acquired.

Investor Contact:

James J. Loch

Senior Vice President, Chief Financial Officer and Treasurer

Digi International

952-912-3737

Email: jamie.loch@digi.com

For more information, visit Digi's website at www.digi.com, or call 877-912-3444 (U.S.) or 952-912-3444 (International).