Digi Smart Solutions™ Group Launches

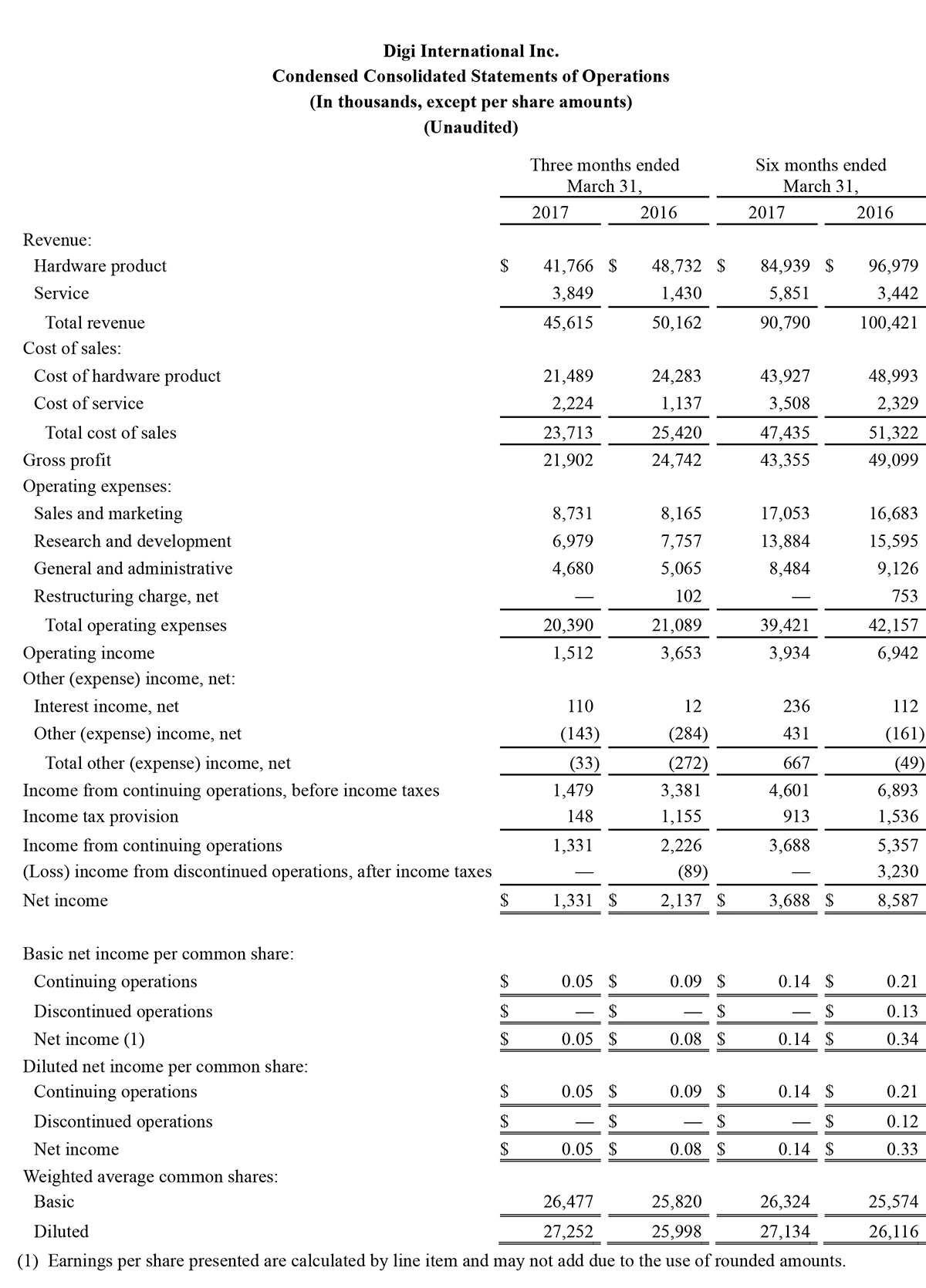

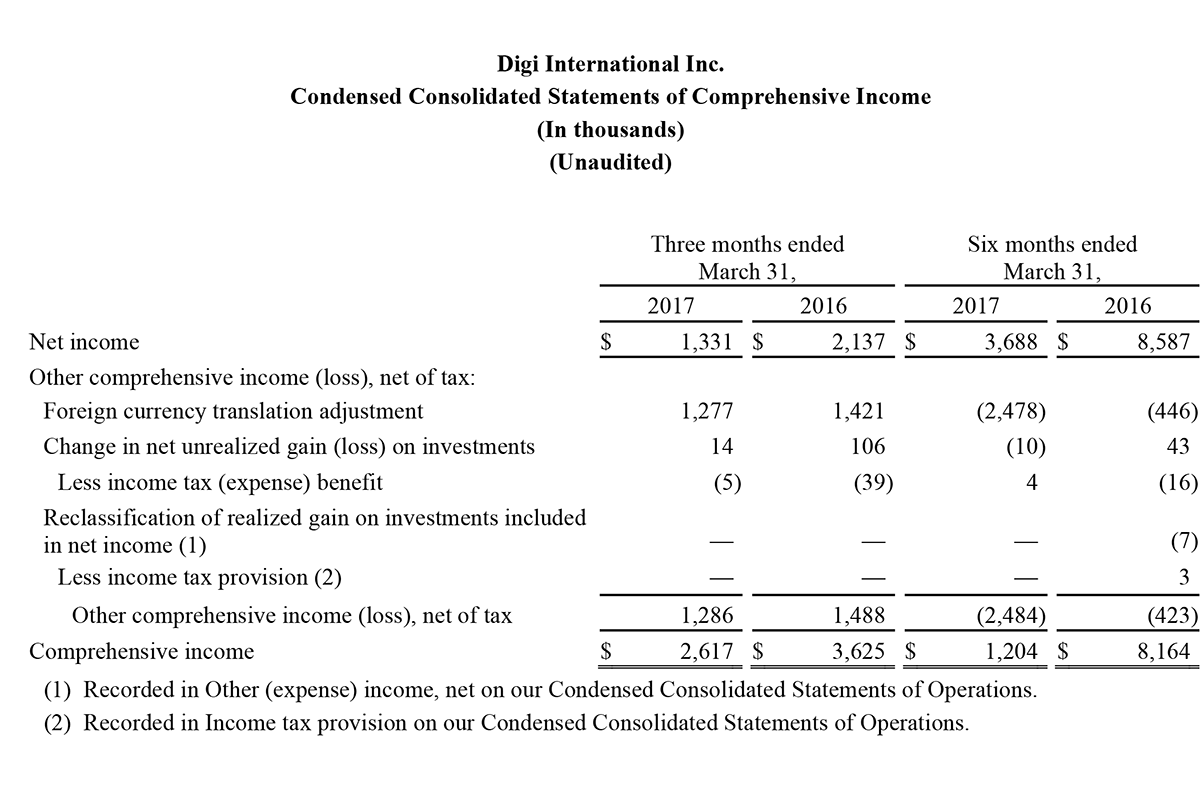

(Minneapolis, MN, May 4, 2017) - Digi International® Inc. (NASDAQ: DGII), a leading global provider of machine-to-machine (M2M) and Internet of Things (IoT) connectivity products and services, reported revenue of $45.6 million for the second fiscal quarter of 2017 compared to $50.2 million in the second fiscal quarter of 2016. Net income for the second fiscal quarter of 2017 was $1.3 million, or $0.05 per diluted share, compared to net income for the second fiscal quarter of 2016 of $2.1 million, or $0.08 per diluted share.

EBITDA from Continuing Operations (Earnings Before Interest, Taxes, Depreciation and Amortization) in the second fiscal quarter of 2017 was $2.8 million, or 6.0% of total revenue, compared to $4.6 million, or 9.1% of total revenue, in the second fiscal quarter of 2016. Please see Reconciliation of Income from Continuing Operations to EBITDA from Continuing Operations later in this earnings release.

Stock-based compensation expense was $1.1 million in the second fiscal quarter of 2017 compared to $0.9 million in the second fiscal quarter of 2016. Stock-based compensation is included in EBITDA. Also included in EBITDA for the second fiscal quarter of 2017 was approximately $1.5 million of expenses associated with merger and acquisition (M&A) activity compared to $0.8 million of M&A activity in the second fiscal quarter of 2016.

Earlier today, Digi announced the rebranding of its Digi Cold Chain Solutions to Digi Smart Solutions™ group.

“We generated significant growth in our service offerings led by our Digi Smart Solutions group,” said Digi’s CEO and President, Ronald E. Konezny. "Our performance in our service business, however, was more than offset by softness across our product business. Our products business is continuing to transition from a custom provider to fewer offerings with broader applications. Although our results did not meet our expectations this quarter, we remain confident in our strategy and our growth prospects.”

Acquisition Activity

SMART Temps - As previously announced on January 9, 2017, Digi purchased all of the outstanding interests of SMART Temps, LLC for approximately $29 million. SMART Temps continues to operate from its Indiana-based headquarters and extends Digi's capabilities of remote monitoring by adding pharmacies, education, blood bank, laboratory environments, and hospital settings. SMART Temps also provides real-time temperature management for markets in which Digi Smart Solutions already served, such as restaurants and grocery.

This acquisition is complementary for Digi as SMART Temps further enhances Digi's portfolio of Smart Solution's products. Digi Smart Solution's revenue is included in the Company's service revenue. This is the third acquisition by the Company since October 2015 and has resulted in Digi becoming a leader in the large and fragmented smart solutions market.

Our cellular product category includes cellular routers and all gateways, and the RF product category includes XBee® modules as well as other RF Solutions. The embedded product category includes Digi Connect® and Rabbit® embedded systems on module and single board computers. The network product category, which has the highest concentration of mature products, includes console and serial servers and USB connected products. Our service offerings include Digi Smart Solutions, wireless design services, revenue generated from the Digi Device Cloud platform and enterprise support services.

Total revenue fell 9.1% to $45.6 million in the second fiscal quarter 2017 from $50.2 million in the second fiscal quarter 2016.

- Product revenue decreased by $7.0 million, or 14.3%, in the second fiscal quarter of 2017 compared to the second fiscal quarter of 2016. All product categories declined, with the exception of RF which was flat with the same quarter a year ago. Our decline in network product revenue was as expected as our customers decreased their support and maintenance of legacy hardwire network products. Embedded and cellular product revenue also declined as we had large sales to significant customers in the prior fiscal year.

- Service revenue increased by $2.4 million, or 169.2%, in the second fiscal quarter of 2017 compared to the comparable quarter in fiscal 2016. The increase was driven primarily by the growth of our Digi Smart Solutions business, which includes $1.5 million of incremental revenue from the acquisition of SMART Temps and FreshTemp in the second fiscal quarter of 2017.

Gross profit was $21.9 million, or 48.0% of revenue in the second fiscal quarter of 2017 compared to $24.7 million, or 49.3% of revenue in the same period of the prior year, a decrease of $2.8 million. Gross profit was negatively impacted by lower revenue and product mix as the network category, which traditionally has higher margin products, declined. This was offset partially by an increase in service gross profit during the second quarter of fiscal 2017 compared to the same period in the prior fiscal year.

Operating income for the second fiscal quarter of 2017 was $1.5 million, or 3.3% of revenue, compared to an operating income of $3.6 million or 7.3% of revenue, for the second fiscal quarter of 2016, a decrease of $2.1 million. The operating income decline was a result of the decrease in gross profit of $2.8 million as described above, partially offset by operating expense savings of $0.7 million. Operating expenses decreased by $1.9 million in the second quarter of fiscal 2017 compared to the same period in the prior fiscal year as we recorded lower incentive compensation since plan thresholds are not expected to be met. Operating expense included $1.5 million of M&A expenses in the second fiscal quarter of 2017 compared to $0.8 million of M&A expenses in the second fiscal quarter of 2016.

Income from Continuing Operations was $1.3 million in the second fiscal quarter of 2017, or $0.05 per diluted share, compared to $2.2 million, or $0.09 per diluted share, in the second fiscal quarter of 2016.

Loss from Discontinued Operations, after income taxes had no activity in fiscal 2017, but incurred a loss of $0.1 million in the second fiscal quarter of 2016 due to expenses associated with the sale of the Etherios business in October 2015 to West Monroe Partners.

EBITDA from Continuing Operations in the second fiscal quarter of 2017 was $2.8 million, or 6.0% of total revenue, compared to $4.6 million, or 9.1% of total revenue, in the second fiscal quarter of 2016.

Please refer to the tables later in this earnings release that provide reconciliations from GAAP to non-GAAP information.

Business Results for the Six Months Ended March 31, 2017 and 2016

Total revenue decreased 9.6% to $90.8 million in the first six months of 2017 from $100.4 million in the first six months of 2016.

- Hardware product revenue decreased by $12.0 million, or 12.4%, in the first six months of fiscal 2017 compared to the first six months of fiscal 2016. This decrease occurred in all product categories, other than cellular routers and gateways which were flat with the first six months of the prior fiscal year. Our decline in network product revenue was as expected as our customers decreased their support and maintenance of legacy hardwire network products. Embedded and RF product revenue also declined as we had large sales to significant customers in the prior fiscal year.

- Service revenue increased by $2.4 million, or 70.0%, in the first six months of fiscal 2017 compared to the first six months of fiscal 2016. This was driven primarily by the growth of our Digi Smart Solutions business. Service revenue includes $1.5 million of incremental revenue from the acquisition of SMART Temps and FreshTemp in the first half of fiscal 2017.

- Included in revenue performance for the year was a foreign currency translation decrease of $0.4 million when compared to the same period in the prior fiscal year, primarily caused by the weakening of the British Pound and Euro against the U.S. dollar.

Gross profit was $43.4 million, or 47.7% of revenue in the first six months of fiscal 2017 compared to $49.1 million, or 48.9% of revenue for the same period in the prior fiscal year, a decrease of $5.7 million. Gross profit was negatively impacted by lower revenue and product mix during the first half of fiscal 2017 compared to the same period in the prior fiscal year, driven by the decline of the network category which has higher margin products compared to our other hardware products. This was partially offset by an increase in service gross profit for the first half of fiscal 2017 compared to the same period in the prior fiscal year.

Operating income for the first six months of fiscal 2017 was $3.9 million, or 4.3% of revenue, as compared to operating income of $6.9 million, or 6.9% of revenue, for the same period in the prior fiscal year, a decrease of $3.0 million. The operating income decline was a result of the decrease in gross profit of $5.7 million as described above, partially offset by operating expense savings of $2.7 million, primarily due to lower incentive compensation since plan thresholds are not expected to be met. Operating income for fiscal 2016 included restructuring expenses of $0.8 million primarily pertaining to corporate staff and related employee termination costs associated with the merging of Digi's Dortmund, Germany and Munich, Germany offices and the consolidation of Digi's Minneapolis office into its Minnetonka headquarters, which included lease termination charges for the downtown Minneapolis office. Operating income also included $1.8 million of M&A expenses in the first half of fiscal 2017 compared to $0.8 million of M&A expenses in the second half of fiscal 2016.

Income from Continuing Operations was $3.7 million in the first six months of fiscal 2017, or $0.14 per diluted share, compared to $5.4 million, or $0.21 per diluted share, in the first six months of fiscal 2016.

Income from Discontinued Operations, after income taxes had no activity in fiscal 2017, but was $3.2 million in the first six months of fiscal 2016, or $0.12 per diluted share resulting from the sale of the Etherios business in October 2015 to West Monroe Partners.

EBITDA from Continuing Operations in the first six months of fiscal 2017 was $6.8 million, or 7.4% of total revenue, compared to $9.2 million, or 9.1% of total revenue, in the first six months of fiscal 2016. Stock compensation expense included in our EBITDA from continuing operations for the first six months of fiscal 2017 and 2016 was $2.3 million and $1.7 million, respectively.

Please refer to the tables later in this earnings release for reconciliations from GAAP to non-GAAP information.

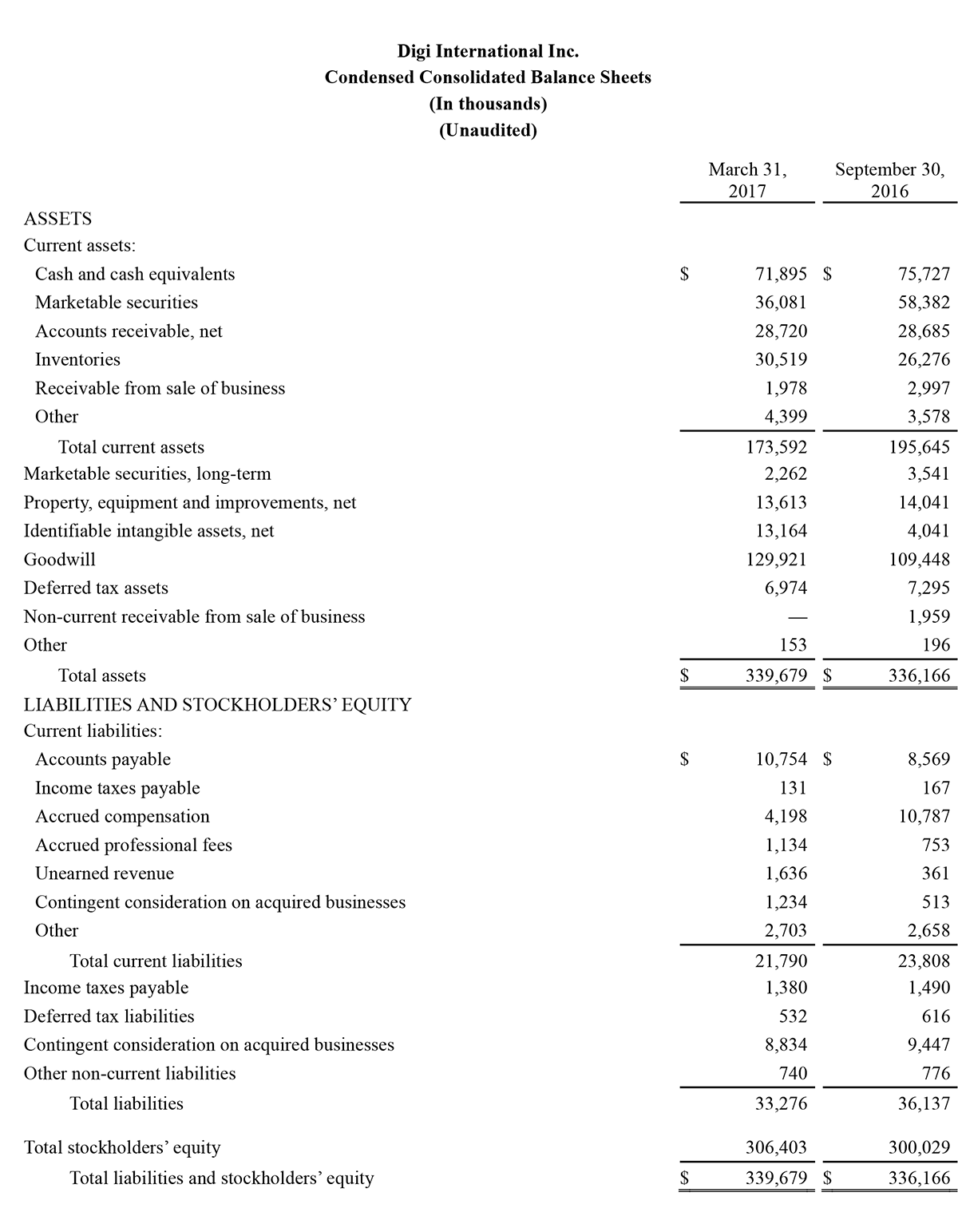

Balance Sheet, Liquidity and Capital Structure

Digi continues to maintain a strong balance sheet. As of March 31, 2017, Digi had:

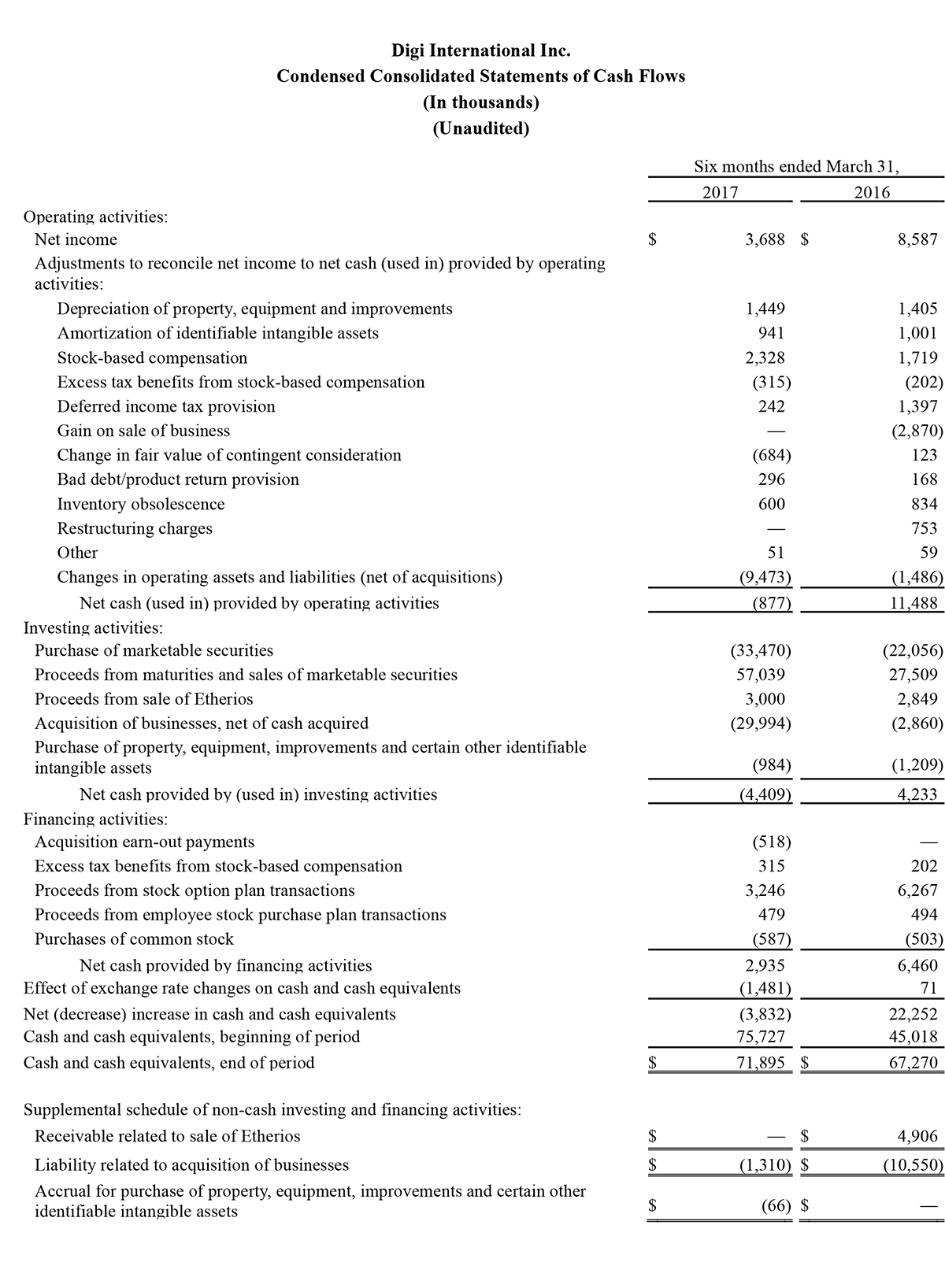

- Cash and cash equivalents and marketable securities balance, including long-term marketable securities, of $110.2 million, a decrease of $27.4 million from the end of fiscal 2016. Digi completed two of its three acquisitions in the first half of fiscal 2017, for a total cash expenditure of $30.0 million (net of cash acquired of $0.5 million). The other acquisition was completed in October 2015. Please refer to the Condensed Consolidated Statements of Cash Flows for more information.

- No debt.

A current ratio of 8.0 to 1, compared to 8.2 to 1 at September 30, 2016.

Customer Highlights

- A large system integrator selected Digi’s WR44RR, rugged cellular router design for on-board rail vehicles, for CCTV control and retrofit of a major northeastern United States metropolitan commuter rail system.

- The Digi WR44R was selected for communications of on-board vehicle fare collection for a Southeastern United States city-wide bus upgrade program.

- An industry leading manufacturer and installer of commercial and utility-grade build automation and HVAC applications selected Digi’s WR31 cellular router for their energy management system communications.

- Digi’s Xbee Cellular was integrated into an energy controller for real-time data monitoring and consumption management for residential water heating systems.

- A leading provider of moisture sensors, weather stations, and irrigation controllers integrated Digi’s Xbee Cellular for real time field data to make intelligent irrigation/water management decisions.

Digi Smart Solutions (formerly Digi Cold Chain Solutions)

- Rapid City Area Schools is a public school district serving Rapid City, South Dakota with 25 schools and is the largest public school district in South Dakota. They have implemented the Digi SmartTemps solution for education to proactively monitor their walk in refrigeration units/milk coolers and storage rooms. Rapid City area schools saved approximately $3,000 dollars the first week of installation.

- Digi International was awarded a sole source contract from Lauderdale County School District in Lauderdale County, Mississippi. The Digi SmartTemps solution for education was chosen to protect their school district comprised of eight schools.

- The University of San Diego serves approximately 2,500 meals per day and has chosen the Digi SmartTemps for education solution to protect their 12 individual kitchens on campus. The University of San Diego is ranked number 17 in the nation for Best Campus Food by the Princeton Review 2017.

Fiscal 2017 Guidance

The following guidance does not include any potential restructuring actions we may implement in future periods. The company has been evaluating strategic alternatives to reduce operating expenses in the near term, including a restructuring of certain operations in the EMEA region.

For the third fiscal quarter of 2017, Digi projects revenue to be in a range of $44 million to $47 million and income per diluted share from continuing operations to be in a range of $0.03 to $0.06.

For the full fiscal year 2017, Digi projects revenue to be in a range of $182 million to $189 million, and income per diluted share from continuing operations to be in a range of $0.24 to $0.30.

Second Fiscal Quarter 2017 Conference Call Details

As announced on April 6, 2017, Digi will discuss its second fiscal quarter results on a conference call on Thursday, May 4, 2017 after market close at 5:00 p.m. EDT (4:00 p.m. CDT). The call will be hosted by Ron Konezny, President and Chief Executive Officer and Mike Goergen, Chief Financial Officer.

Digi invites all those interested in hearing management's discussion of its quarter to access a live webcast of the conference call through the investor relations section of Digi's website at www.digi.com. Participants may also join the call directly by dialing (855) 638-5675 and entering passcode 3010970. International participants may access the call by dialing (262) 912-4765 and entering passcode 3010970. A replay will be available within approximately three hours after the completion of the call, and for one week following the call, by dialing (855) 859-2056 for domestic participants or (404) 537-3406 for international participants and entering access code 3010970 when prompted. A replay of the webcast will be available for one week through Digi's website.

A copy of this earnings release can be accessed through the financial releases page of the investor relations section of Digi's website at www.digi.com.

For more news and information on Digi International Inc., please visit www.digi.com/aboutus/investorrelations.

About Digi International

Digi International (NASDAQ: DGII) is a leading global provider of business and mission–critical machine–to–machine (M2M) and Internet of Things (IoT) connectivity products and services. We help our customers create next–generation connected products and deploy and manage critical communications infrastructures in demanding environments with high levels of security, relentless reliability and bulletproof performance. Founded in 1985, we’ve helped our customers connect over 100 million things, and growing. For more information, visit Digi's website at www.digi.com, or call 877–912–3444 (U.S.) or 952–912–3444 (International).

Forward-Looking Statements

This press release contains forward-looking statements that are based on management’s current expectations and assumptions. These statements often can be identified by the use of forward-looking terminology such as "anticipate," "believe," "estimate," "looking forward," "may," "will," "expect," "plan," "project," "should," or "continue" or the negative thereof or other variations thereon or similar terminology. Among other items, these statements relate to expectations of the business environment in which the company operates, projections of future performance, perceived marketplace opportunities and statements regarding our mission and vision. Such statements are not guarantees of future performance and involve certain risks, uncertainties and assumptions. Among others, these include risks related to the highly competitive market in which our company operates, rapid changes in technologies that may displace products sold by us, declining prices of networking products, our reliance on distributors and other third parties to sell our products, delays in product development efforts, uncertainty in user acceptance of our products, the ability to integrate our products and services with those of other parties in a commercially accepted manner, potential liabilities that can arise if any of our products have design or manufacturing defects, our ability to defend or settle satisfactorily any litigation, uncertainty in global economic conditions and economic conditions within particular regions of the world which could negatively affect product demand and the financial solvency of customers and suppliers, the impact of natural disasters and other events beyond our control that could negatively impact our supply chain and customers, potential unintended consequences associated with restructuring or other similar business initiatives that may impact our ability to retain important employees, the ability to achieve the anticipated benefits and synergies associated with acquisitions or divestitures, and changes in our level of revenue or profitability which can fluctuate for many reasons beyond our control. These and other risks, uncertainties and assumptions identified from time to time in our filings with the United States Securities and Exchange Commission, including without limitation, our annual report on Form 10-K for the year ended September 30, 2016 and subsequent quarterly reports on Form 10-Q and other filings, could cause the company's future results to differ materially from those expressed in any forward-looking statements made by us or on our behalf. Many of such factors are beyond our ability to control or predict. These forward-looking statements speak only as of the date for which they are made. We disclaim any intent or obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise.

Presentation of Non-GAAP Financial Measures

This release includes adjusted income from continuing operations, adjusted income per diluted share from continuing operations, and EBITDA from continuing operations, each of which is a non-GAAP measure.

We understand that there are material limitations on the use of non-GAAP measures. Non-GAAP measures are not substitutes for GAAP measures, such as net income, for the purpose of analyzing financial performance. The disclosure of these measures does not reflect all charges and gains that were actually recognized by the company. These non-GAAP measures are not in accordance with, or an alternative for measures prepared in accordance with, generally accepted accounting principles and may be different from non-GAAP measures used by other companies. In addition, these non-GAAP measures are not based on any comprehensive set of accounting rules or principles. We believe that non-GAAP measures have limitations in that they do not reflect all of the amounts associated with our results of operations as determined in accordance with GAAP and that these measures should only be used to evaluate our results of operations in conjunction with the corresponding GAAP measures. Additionally, we understand that EBITDA from continuing operations does not reflect our cash expenditures, the cash requirements for the replacement of depreciated and amortized assets, or changes in or cash requirements for our working capital needs.

We believe that providing historical and adjusted income and income per diluted share from continuing operations, respectively, exclusive of such items as reversals of tax reserves, discrete tax benefits and restructuring permits investors to compare results with prior periods that did not include these items. Management uses the aforementioned non-GAAP measures to monitor and evaluate ongoing operating results and trends and to gain an understanding of our comparative operating performance. In addition, certain of our stockholders have expressed an interest in seeing financial performance measures exclusive of the impact of matters such as the impact of decisions related to taxes and restructuring, which while important, are not central to the core operations of our business. Additionally, management believes that the presentation of EBITDA from continuing operations as a percentage of revenue is useful because it provides a reliable and consistent approach to measuring our performance from year to year and in assessing our performance against that of other companies. We believe this information helps compare operating results and corporate performance exclusive of the impact of our capital structure and the method by which assets were acquired. EBITDA from continuing operations is used as an internal metric for executive compensation, as well as incentive compensation for the rest of the employee base, and it is monitored quarterly for these purposes.

Investor Contact:

Mike Goergen

Senior Vice President, Chief Financial Officer and Treasurer

Digi International

952-912-3737

Email: mike.goergen@digi.com

For more information, visit Digi's Web site at www.digi.com, or call 877-912-3444 (U.S.) or 952-912-3444 (International).