Record Quarterly Revenue of $109M, End of Quarter ARR of $96M

EPS of $0.16, Adjusted EPS of $0.48

(Minneapolis, MN, February 2, 2023) - Digi International® Inc. (Nasdaq: DGII), a leading global provider of business and mission critical Internet of Things ("IoT") products, services and solutions, today announced its financial results for its first fiscal quarter ended December 31, 2022.

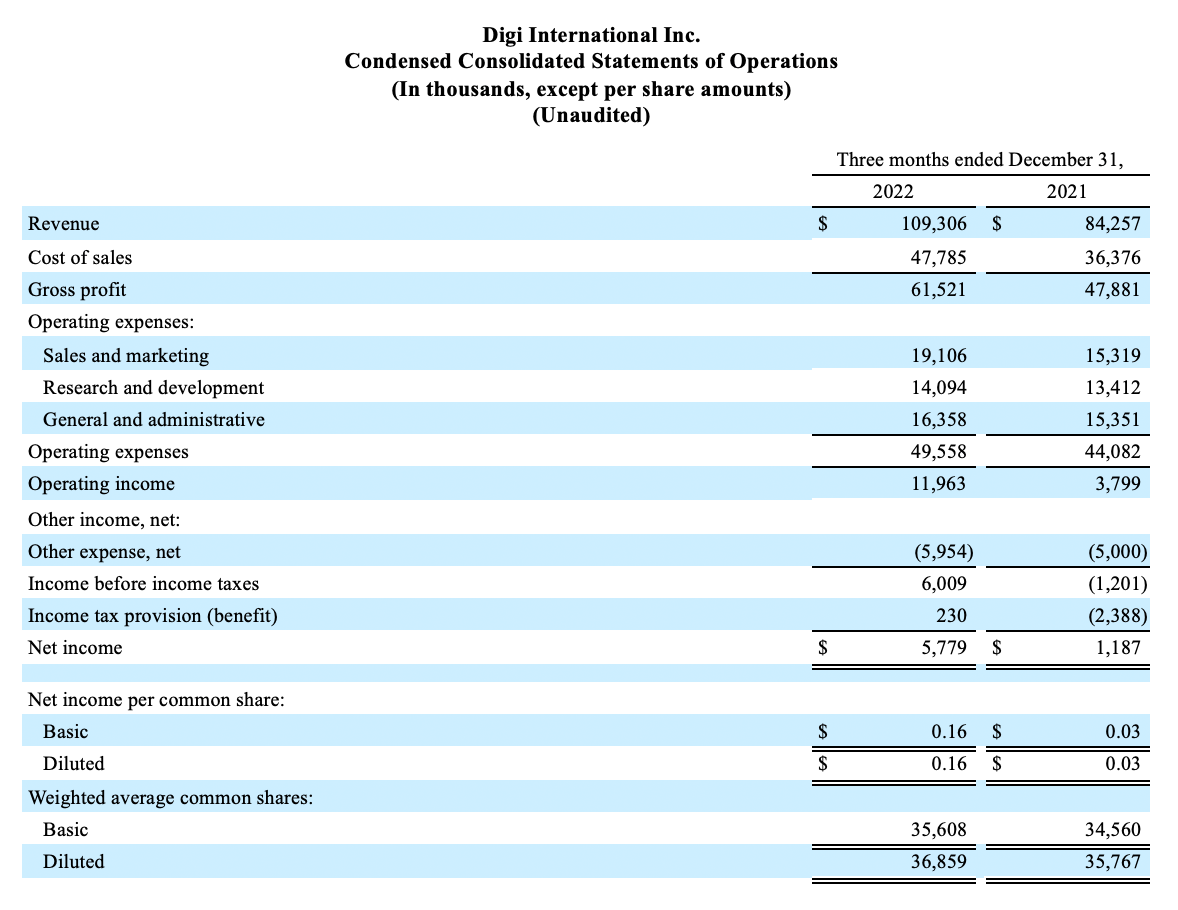

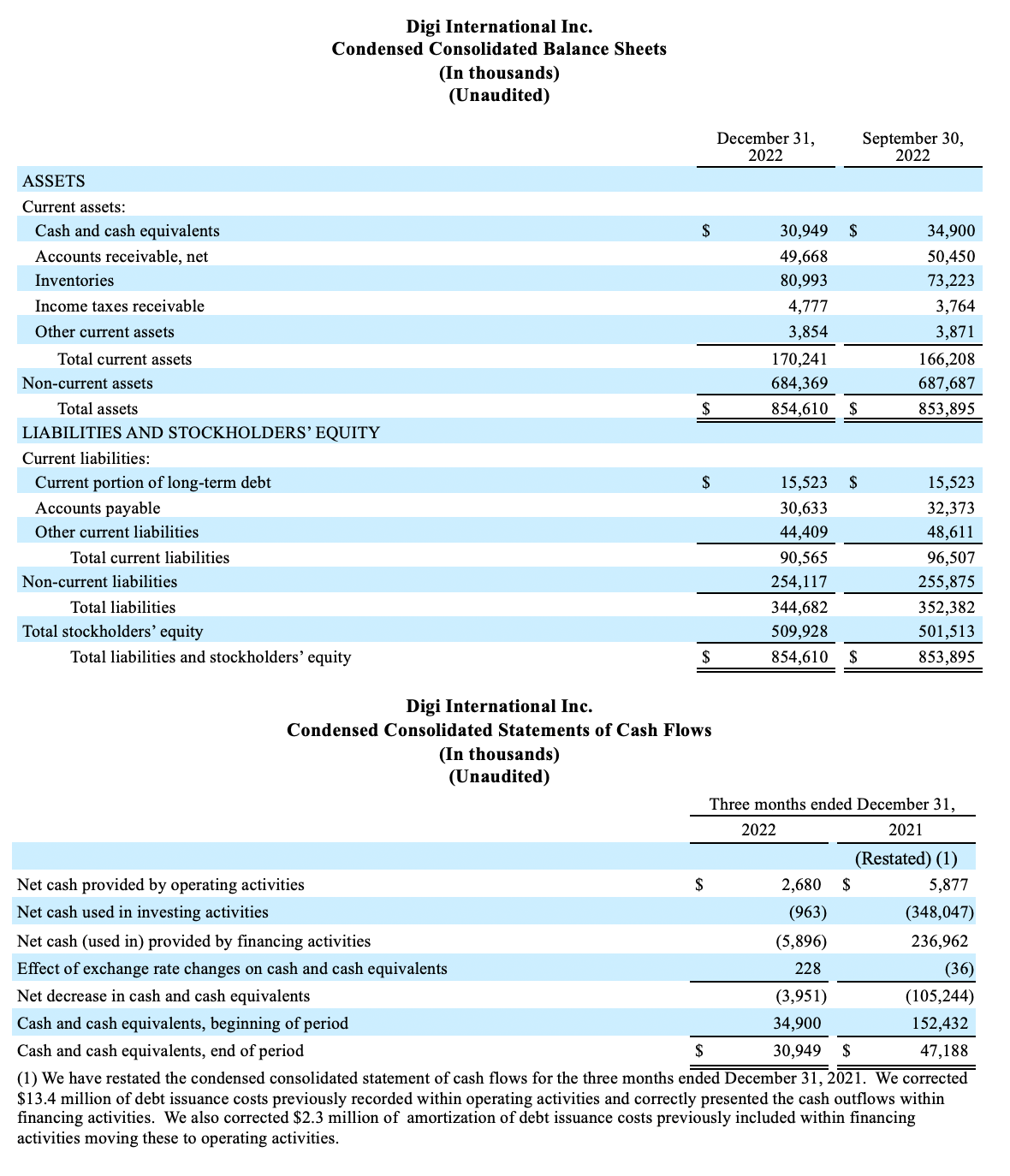

First Fiscal Quarter 2023 Results Compared to First Fiscal Quarter 2022 Results1

- Revenue was $109 million, an increase of 30%.

- Gross profit margin was 56.3% versus 56.8%. Gross profit margin excluding amortization was 57.3% compared to 58.5%.

- Net income per diluted share was $0.16, up from $0.03, an increase of 433%.

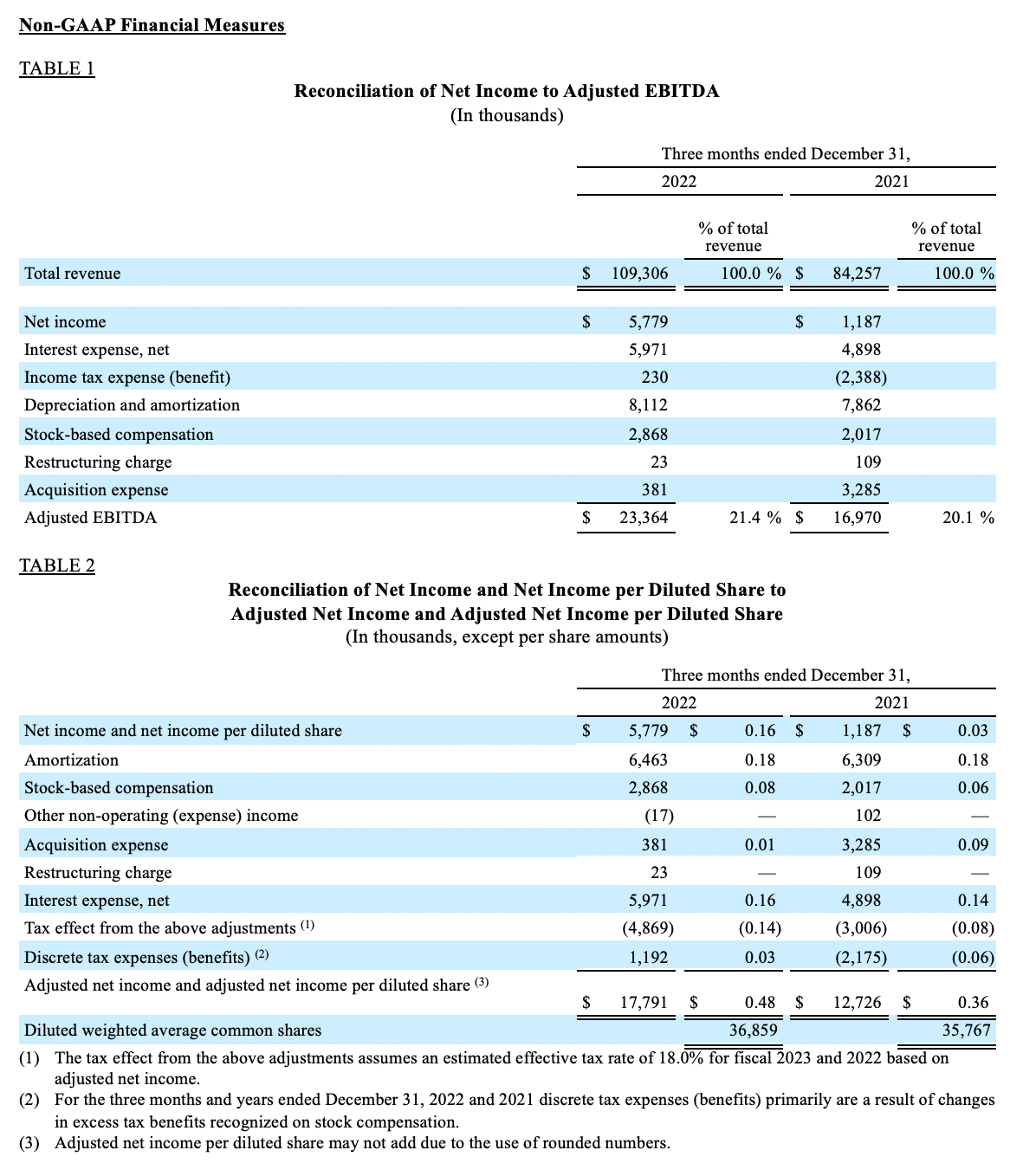

- Adjusted EPS was $0.48 per diluted share, an increase of 33%.

- Adjusted EBITDA was $23 million, an increase of 38%.

- Annualized Recurring Revenue (ARR) was $96 million at quarter end, an increase of 8%.

1 First fiscal quarter 2023 results include the results of Ventus for the entire quarter, while first fiscal quarter 2022 results include Ventus results following its acquisition on November 1, 2022.

Reconciliations of GAAP and non-GAAP financial measures appear at the end of this release.

“Digi is off to a fast start to our fiscal 2023, driven by strong demand and a gradually easing supply chain,” said Ron Konezny, President and Chief Executive Officer. “Our fiscal first quarter saw balanced strength across all our business units and geographies. Our business and mission critical solutions are helping drive our customers' digital transformation and delivering valuable ROI. Thank you for the incredible performance by the Digi team and our suppliers and channel partners.”

Segment Results

IoT Product & Services

The segment's first fiscal quarter 2023 revenues of $84 million increased 28% from the same period in the prior fiscal year. This increase is attributable primarily to revenue growth from our OEM, console server and cellular product lines. ARR as of the end of the first fiscal quarter was over $14 million. Gross profit margin increased 30 basis points to 54.6% of revenues for the first fiscal quarter of 2023, due to product and customer mix.

IoT Solutions

The segment's first fiscal quarter 2023 revenues of $25 million increased 35% from the same period in the prior fiscal year. This increase primarily was driven by Ventus. ARR as of the end of the first fiscal quarter was $82 million. Gross profit margin decreased 380 basis points to 62.1%, due to increased expenses relating to inventory reserves in the first fiscal quarter of 2023.

Second Fiscal Quarter 2023 and Full-Year 2023 Guidance

With consideration to the supply chain and the other challenging macro conditions, we are providing the following guidance for our second quarter of fiscal 2023:

We expect to see revenues of $105 million to $109 million, with Adjusted EBITDA between $21.0 million and $22.5 million. Using a diluted share count of 37.0 million shares outstanding, we project our Adjusted EPS to be $0.42 to 0.46 per diluted share. We provide earnings guidance on a non-GAAP basis as it is difficult to predict with reasonable certainty items including but not limited to the impact of foreign exchange translation, restructuring, interest and certain tax related events. Given the uncertainty, any of these items could have a significant impact on U.S. GAAP results.

Based on our first fiscal quarter performance and second fiscal quarter guidance, we have stronger confidence in our annual projections for FY23. We now expect to grow revenues in excess of 10% as the supply chain continues to ease and demand remains strong. We expect ARR and A-EBITDA to grow faster than our revenue growth.

First Fiscal Quarter 2023 Conference Call Details

As announced on January 11, 2023, Digi will discuss its first fiscal quarter results on a conference call on Thursday, February 2, 2023 at 10:00 a.m. ET (9:00 a.m. CT). The call will be hosted by Ron Konezny, President and Chief Executive Officer and Jamie Loch, Chief Financial Officer.

Participants may register for the conference call at: https://register.vevent.com/register/BI466515f78c73455897c9e895bf3daaf4. Once registration is completed, participants will be provided a dial-in number and passcode to access the call. All participants are asked to dial-in 15 minutes prior to the start time.

Participants may access a live webcast of the conference call through the investor relations section of Digi’s website, or the hosting website at: https://edge.media-server.com/mmc/p/57ptvnxa.

A replay will be available within approximately two hours after the completion of the call for approximately one year. You may access the replay via webcast through the investor relations section of Digi’s website.

A copy of this earnings release, as well as a shareholder letter relating to our first fiscal quarter results can be accessed through the financial releases page of the investor relations section of Digi's website at www.digi.com.

For more news and information on us, please visit www.digi.com/aboutus/investorrelations.

About Digi International

Digi International (Nasdaq: DGII) is a leading global provider of IoT connectivity products, services and solutions. We help our customers create next-generation connected products and deploy and manage critical communications infrastructures in demanding environments with high levels of security and reliability. Founded in 1985, we’ve helped our customers connect over 100 million things and growing. For more information, visit Digi's website at www.digi.com.

Forward-Looking Statements

This press release contains forward-looking statements that are based on management’s current expectations and assumptions. These statements often can be identified by the use of forward-looking terminology such as "assume," "believe," "anticipate," "intend," "estimate," "target," "may," "will," "expect," "plan," "potential," "project," "should," or "continue," or the negative thereof or other variations thereon or similar terminology. Among other items, these statements relate to expectations of the business environment in which Digi operates, projections of future performance, perceived marketplace opportunities and statements regarding our mission and vision. Such statements are not guarantees of future performance and involve certain risks, uncertainties and assumptions. Among others, these include risks related to the ongoing supply chain and transportation challenges impacting businesses globally, the ongoing COVID-19 pandemic and efforts to mitigate the same, risks related to ongoing inflationary pressures as well as present concerns about a potential recession and the ability of companies like us to operate a global business in such conditions, risks arising from the present war in Ukraine, the highly competitive market in which our company operates, rapid changes in technologies that may displace products sold by us, declining prices of networking products, our reliance on distributors and other third parties to sell our products, the potential for significant purchase orders to be canceled or changed, delays in product development efforts, uncertainty in user acceptance of our products, the ability to integrate our products and services with those of other parties in a commercially accepted manner, potential liabilities that can arise if any of our products have design or manufacturing defects, our ability to integrate and realize the expected benefits of acquisitions, our ability to defend or settle satisfactorily any litigation, uncertainty in global economic conditions and economic conditions within particular regions of the world which could negatively affect product demand and the financial solvency of customers and suppliers, the impact of natural disasters and other events beyond our control that could negatively impact our supply chain and customers, potential unintended consequences associated with restructuring, reorganizations or other similar business initiatives that may impact our ability to retain important employees or otherwise impact our operations in unintended and adverse ways, and changes in our level of revenue or profitability which can fluctuate for many reasons beyond our control. These and other risks, uncertainties and assumptions identified from time to time in our filings with the United States Securities and Exchange Commission, including without limitation, our Annual Report on Form 10-K for the year ended September 30, 2022, could cause our actual results to differ materially from those expressed in any forward-looking statements made by us or on our behalf. Many of such factors are beyond our ability to control or predict. These forward-looking statements speak only as of the date for which they are made. We disclaim any intent or obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise.

Presentation of Non-GAAP Financial Measures

This press release includes adjusted net income, adjusted net income per diluted share and Adjusted EBITDA, each of which is a non-GAAP measure.

We understand that there are material limitations on the use of non-GAAP measures. Non-GAAP measures are not substitutes for GAAP measures, such as net income, for the purpose of analyzing financial performance. The disclosure of these measures does not reflect all charges and gains that were actually recognized by Digi. These non-GAAP measures are not in accordance with, or an alternative for measures prepared in accordance with, generally accepted accounting principles and may be different from non-GAAP measures used by other companies or presented by us in prior reports. In addition, these non-GAAP measures are not based on any comprehensive set of accounting rules or principles. We believe that non-GAAP measures have limitations in that they do not reflect all of the amounts associated with our results of operations as determined in accordance with GAAP. We believe these measures should only be used to evaluate our results of operations in conjunction with the corresponding GAAP measures. Additionally, Adjusted EBITDA does not reflect our cash expenditures, the cash requirements for the replacement of depreciated and amortized assets, or changes in or cash requirements for our working capital needs.

We believe that providing historical and adjusted net income and adjusted net income per diluted share, respectively, exclusive of such items as reversals of tax reserves, discrete tax benefits, restructuring charges and reversals, intangible amortization, stock-based compensation, other non-operating income/expense, changes in fair value of contingent consideration, acquisition-related expenses and interest expense related to acquisitions permits investors to compare results with prior periods that did not include these items. Management uses the aforementioned non-GAAP measures to monitor and evaluate ongoing operating results and trends and to gain an understanding of our comparative operating performance. In addition, certain of our stockholders have expressed an interest in seeing financial performance measures exclusive of the impact of these matters, which while important, are not central to the core operations of our business. Management believes that Adjusted EBITDA, defined as EBITDA adjusted for stock-based compensation expense, acquisition-related expenses, restructuring charges and reversals, and changes in fair value of contingent consideration is useful to investors to evaluate our core operating results and financial performance because it excludes items that are significant non-cash or non-recurring items reflected in the Condensed Consolidated Statements of Operations. We believe that the presentation of Adjusted EBITDA as a percentage of revenue is useful because it provides a reliable and consistent approach to measuring our performance from year to year and in assessing our performance against that of other companies. We believe this information helps compare operating results and corporate performance exclusive of the impact of our capital structure and the method by which assets were acquired.

Investor Contact:

Rob Bennett

Investor Relations

Digi International

952-912-3524

Email: rob.bennett@digi.com